CrefoScore

klasifikācija

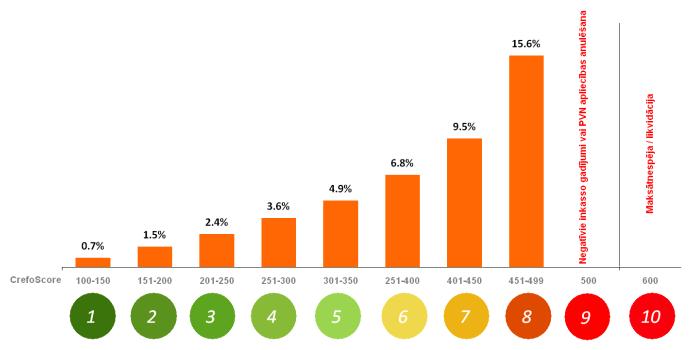

Ērtākai CrefoScore indeksa rezultātu izmantošanai izveidota riska grupu klasifikācija. Pirmajā un otrajā riska grupā ir uzņēmumi ar izciliem maksātspējas rādītājiem, kuriem pēc esošajiem aprēķiniem atbilst tikai 1,5% Latvijas uzņēmumu. Savukārt, 10.riska grupa būtībā nozīmē uzņēmuma maksātnespēju un likvidācijas procesu.

CrefoCert sertifikātu var iegūt tikai tie uzņēmumi, kuru CrefoScore indekss 100-250 jeb ietilpst 1.-3.riska grupā, attiecīgi maksātspējas rādītāji ir augsti, bet kredītriski – zemi.